Using Multiple Costing Methods in JD Edwards Inventory – The Fallout

Using Multiple Costing Methods in JD Edwards Inventory – The Fallout

Edward Gutkowski | Chief Architect - RapidReconciler

When setting up inventory items in JD Edwards, one of the most important steps is assigning the cost method to be used in the valuation. Examples of the various options include:

01 – Last-In Cost

02 – Weighted Average

07 – Standard Cost

Etc …

Companies normally determine a single method and apply it to all of the items in their JD Edwards system, but in some cases I have seen standard costing used for some items and actual costing (weighted average) for others. This can present accounting fallout when it comes to transactional entries booked to the general ledger. Let me explain.

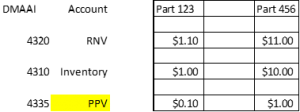

In this scenario, let’s say we have 2 purchased parts (123 and 456). Part number 123 is set up as a standard cost item with a value of $1 and part number 456 is an actual cost item with a value of $10. There are no units on hand for either item.

Now we issue a purchase order to the same vendor for both parts. The vendor charges us $1.10 for part 123 and $11 for part 456. How will these entries be recorded in the general ledger?

First, we must understand the distribution/manufacturing automatic accounting instruction (DMAAI) set up for purchase order receipts. There are 3 main DMAAI tables used in the process:

4320 – Received Not Vouchered. The account specified accrues the entire liability we must pay to the vendor.

4310 – Perpetual Inventory. This account holds the value of the units on hand.

4335 – Purchased Part Variance. This account records any cost difference between the standard and what was actually paid.

Here is what the journal entry each part would look like:

Do you see the issue? Since part 456 is an actual cost item, the inventory value should be $11, not $10 and there should be no variance. You can fix that by changing DMAAI 4335 to the inventory account, or can you? That would make the standard cost item post incorrect entries.

The only way to truly fix this is to have SEPARATE GL class codes for the standard cost and actual cost items and be sure not to mix them up. This would be very tedious to maintain.

There you have it! If you have a set up where there are both standard and actual cost items, make sure you have separate GL class codes in order to avoid the accounting fallout.

Happy reconciling!

FOR MORE INFORMATION ON JD EDWARDS 9.2.4 OR GSI'S JD EDWARDS SERVICE OFFERINGS

CONTACT US TODAY

FOR MORE INFORMATION ON JDE 9.2.4 OR GSI'S JD EDWARDS SERVICES