JD Edwards ST/OT Transfer Order Accounting. Part 3

ST/OT Transfer Order Accounting in JD Edwards. Part 3.

Ed Gutkowski - Chief Architect - RapidReconciler

ST/OT transfer orders in JD Edwards are used to move materials between branch plants (A to B) within the same company and employs the use of a clearing account to hold the value of the goods while they are in transit. This balance sheet account differs from a perpetual account because while the goods are in transit the quantities on hand “disappear” from the perpetual counts and only remain as a balance in the clearing account.

My article from last month was about DMAAI set up when transferring goods with a markup. Now let’s take a look at the ‘OT’ side of things using a transfer at cost scenario.

There are 3 main DMAAI tables that come into play during the receipt of an OT order:

4310 – Inventory Debit

4320 – RNV (Used in this case for the Goods In Transit account) Credit

4335 – Purchased part variance

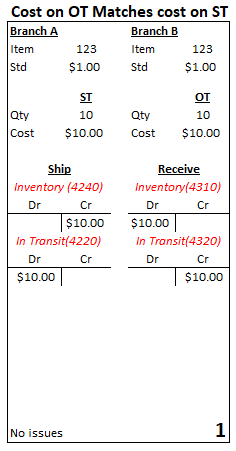

Let’s say we are transferring 10 units of item 123 at $1 each from branch ‘A’ to branch ‘B’. The standard cost in both branch plants is $1 each. The ST sales price is $10, and the OT purchase price matches the sales cost of $1 each.

The 10 units are shipped, and the $10 debit hits the goods-in-transit account as expected.

In a perfect world, nothing will change between the time the units are shipped then received. If this is the case, then all works perfectly, and the purchased part variance account is not even needed.

As you can see the general ledger entries in DMAAI tables 4220 and 4310 for the goods in transit account clear perfectly without any variance to account for.

But what if there is a cost change on the item after the transfer order is entered, but before the shipment occurs? Now we can have an issue when things get out of sync.

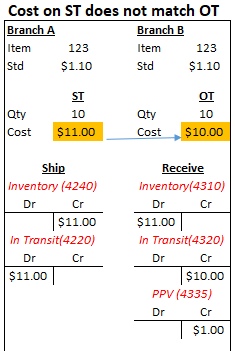

Let’s now say there is a standard cost change in branch ‘A’ from $1 to $1.10. Let’s also say that the standard cost is updated to $1.10 in branch ‘B’ as well. If it is not it, it creates an even more complicated scenario!

Let’s now say there is a standard cost change in branch ‘A’ from $1 to $1.10. Let’s also say that the standard cost is updated to $1.10 in branch ‘B’ as well. If it is not it, it creates an even more complicated scenario!

So, the ST and OT still have the $1 amounts, what happens now?

When the ST is ship confirmed, the ship confirmation program in JD Edwards automatically updates the standard. This results in a proper credit to the inventory account of $11 and matching debit to goods in transit. Now let’s get to the receipt side of things …

When the ST is ship confirmed, the ship confirmation program in JD Edwards automatically updates the standard. This results in a proper credit to the inventory account of $11 and matching debit to goods in transit. Now let’s get to the receipt side of things …

Our OT order is still expecting a $10 receipt. Nothing has updated the $1 unit cost to the new value of $1.10. This is where we can use DMAAI 4335 to still make the accounting work as shown in the figure on the left:

DMAAI 4310 – Remember the standard in branch ‘B’ was updated to $1.10 so it will correctly record an $11 debit.

DMAAI 4320 – Because the unit cost on the purchase order is still $1, it will credit goods in transit only $10, leaving a $1 variance!

DMAAI 4335 – If the account set up here is goods in transit then the $1 variance will also clear from goods in transit, making the accounting work properly.

There you have it. If you set DMAAI 4335 to the Goods in Transit account for OT orders, your accounting will work perfectly for the scenario above. Wait! Are you saying a different scenario may cause other issues? You will need to check out next month’s article to find out! Looking for help with your JD Edwards inventory reconciliation? Contact GSI today.

FOR MORE INFORMATION ON GSI'S JD EDWARDS SERVICE OFFERINGS

CONTACT US TODAY

FOR MORE INFORMATION ON GSI'S JD EDWARDS SERVICES